FILE – In this Wednesday, Sept. 2, 2020, file photo, passers-by walk past a business storefront with store closing and sale signs in Dedham, Mass. U.S. employers advertised for slightly fewer jobs in August while their hiring ticked up modestly. The Labor Department said Tuesday, Oct. 6, 2020, that the number of U.S. job postings on the last day of August dipped to 6.49 million, down from 6.70 million July. (AP Photo/Steven Senne, File)

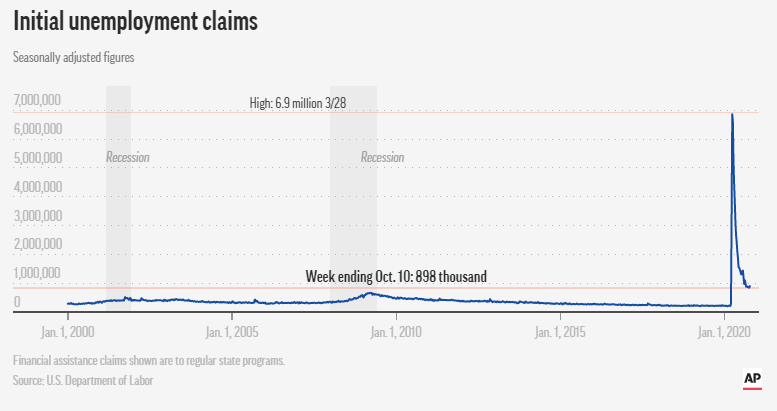

WASHINGTON (AP) — The number of Americans seeking unemployment benefits rose last week by the most in two months, to 898,000, a historically high number and evidence that layoffs remain a hindrance to the economy’s recovery from the pandemic recession.

Thursday’s report from the Labor Department coincides with other recent data that have signaled a slowdown in hiring. The economy is still roughly 10.7 million jobs short of recovering all the 22 million jobs that were lost when the pandemic struck in early spring.

Confirmed coronavirus cases have been rising again nationwide in the past month, likely causing more Americans to hold back from eating out, shopping and engaging in other commerce. Cases have spiked in Wisconsin, for example, prompting renewed restrictions on business in Milwaukee and Madison.

Across the country, applications for unemployment aid are rising while negotiations over a new stimulus package between House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin remain mired in a stalemate.

The job search website Indeed said its job postings were unchanged last week, remaining about 17% below last year’s levels. Many employers still aren’t confident enough in their businesses or in their view of the economy to ramp up hiring. Job postings had rebounded steadily over the summer, but the gains have slowed in the past two months.

“Further recovery looks to have stalled out,” said AnnElizabeth Konkel, an economist at Indeed. “Holiday hiring is sluggish, and many businesses need to make significant changes to ride out the colder months.”

California, which typically accounts for about one-fourth of the nation’s jobless aid applications, has reported the same number of claims for several weeks as a placeholder. That’s because it temporarily stopped processing new applications while it implements anti-fraud technology and clears a backlog of claims.

That means jobless claims rose nationally last week even though they were unchanged in the largest state. Applications rose significantly in 17 states, including Florida, Georgia, Illinois, Indiana and Massachusetts. In Wisconsin, they increased by a quarter to nearly 15,000.

Fraud and issues around double-counting claims have caused many economists to take a more skeptical view of whether jobless aid applications are a precise barometer of layoffs. But most still see an increase in claims as a discouraging sign even if the level may be inflated by people who have filed multiple applications for different programs.

A report Thursday from Moody’s Analytics, a forecasting firm, and Morning Consult, a polling outfit, found that millions of people remain dependent on government aid. Roughly half of respondents in a survey last month said they were still using their $1,200 stimulus checks, which the government distributed in April and May, to pay for expenses. About 15% said they were relying on unemployment benefits.

More than 40% of the unemployed are also relying on financial help from relatives or friends. And 12 million households say they aren’t sure they will be able to keep making their mortgage payments.

The government’s report Thursday, showing that initial requests for jobless aid rose 53,000 last week, also said the number of people who are continuing to receive benefits dropped 1.2 million to 10 million. That decline signals that many of the unemployed are being recalled to their old jobs. But it also means that potentially even more people have used up their regular state benefits — which usually expire after six months — and have transitioned to extended benefit programs that last an additional three months.

Indeed, the number of people receiving extended benefits in late September, the latest data available, jumped 800,000 to 2.8 million. The government also said 373,000 people applied for jobless aid under a separate program that made the self-employed, contractors and gig workers eligible for unemployment benefits for the first time.

That figure was 90,000 lower than in the previous week. These figures aren’t adjusted for seasonal trends, so the government reports them separately from the traditional jobless claims.

Nearly all jobless benefit recipients are now receiving only regular state unemployment payments because a federal weekly supplement of $300 has ended in nearly all states. A $600-a-week federal benefit expired over the summer.

The end of federal aid for the unemployed will likely force many of the jobless to sharply cut their spending, thereby weakening the economy. The full impact may have been delayed, though, by the fact that most of the federal aid was saved or was used to pare debt, according to research by the Federal Reserve Bank of New York.

According to the New York Fed, at the end of June nearly one-quarter of jobless aid payments had been saved. Nearly half were used to pay down debt. Just 28% of the money was spent.

And more than one-third of the $1,200 stimulus checks that went to most adults was saved, with an additional one-third of that money used to pay off debt.

The end of the federal payments has also underscored the dramatically uneven nature of unemployment benefits across states. In Arizona, for example, the maximum weekly payment is only $240, while in neighboring California it’s $450. In Florida and Tennessee, the maximum is just $275. In New Jersey, the top weekly benefit is $713.

Nationwide, on average, unemployment benefits replace about 33% of what recipients earned at their previous job. That is down from 36% in 2009.

“It is a steady downward trend,” said Andrew Stettner, a senior fellow at the Century Foundation. “The formulas have gradually gotten more stingy.”

Some of the lowest benefits are provided in states where Black Americans make up the largest proportion of jobless aid recipients. In Mississippi, for instance, 54% of unemployment aid recipients in August were Black, according the Century Foundation. The maximum benefit in that state is $235 a week. Black Americans are much more likely to work in restaurants, retail stores, hotels and other industries that have suffered enormous job cuts.

In South Carolina, more than one-third of people receiving unemployment aid are Black. The maximum benefit is $326.

Copyright 2020 Associated Press. All rights reserved.

You must be logged in to post a comment Login